Planning Briefs

After 20 Years, America Is Rethinking Social Media

Published Wednesday, February 8, 2023 at: 9:29 AM EST

Social media is soon to hit age 21. The first two decades have been a big disappointment to Americans. That’s a major conclusion from a highly credible study published December 6, 2022, by Pew Research Center, a nonpartisan, nonprofit, and nonadvocacy fact-tank.

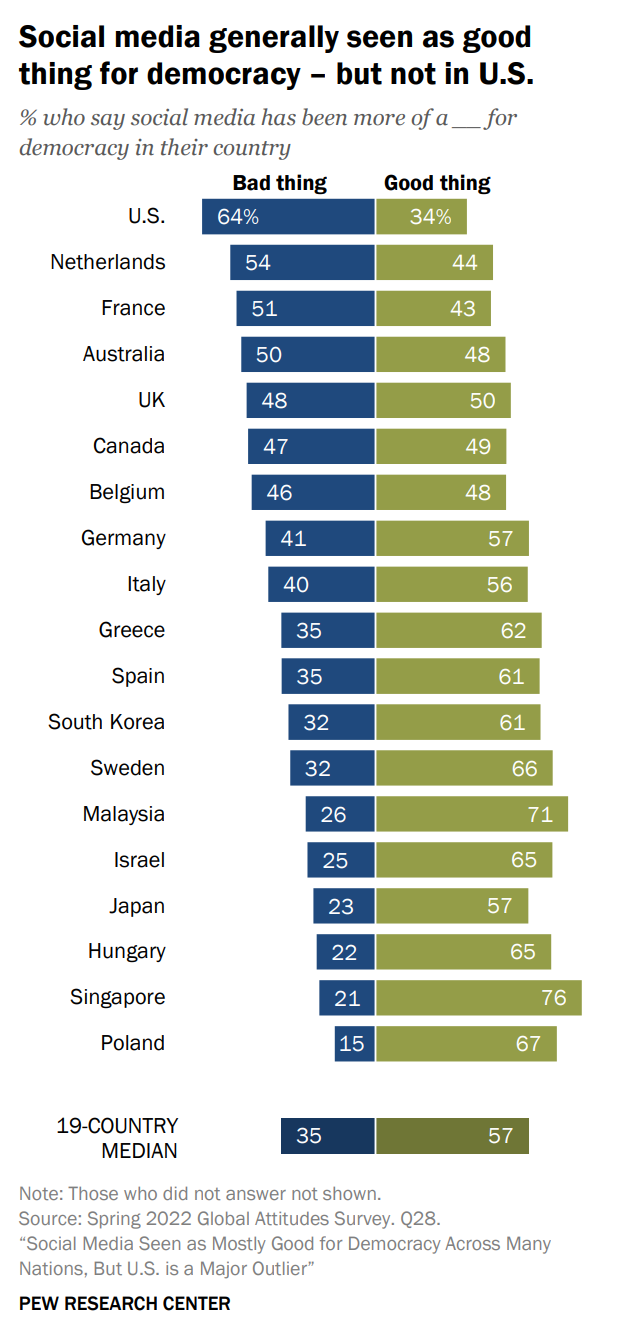

Social media is generally seen as good for democracy across the world, but not so much in the U.S., according to surveys conducted by Pew Research Center of individuals in 19 democracies in Europe and Asia as well as the United States.

The United States is the focus of this summary of the Pew study not because our perspective considers global effects of social media unimportant, but because the U.S. is central in establishing an investment strategy for the long run.

Here are four conclusions from the 82-page study about the effects of social media that are key to investing for the long run.

- Americans say social media has made it easier to manipulate and divide people. It’s fair to say Americans are rethinking social media.

- Across the 19 advanced economies, a median of 84% say technological connectivity has made people easier to manipulate with false information and rumors .

- In the U.S., around half of adults say they either get news often (17%) or sometimes (33%) from social media. When it comes to where Americans regularly get news on social media, Facebook outpaces all other social media sites. Roughly a third of U.S. adults (31%) say they regularly get news from Facebook. While Twitter is only used by about three-in-ten U.S. adults (27%), about half of its users (53%) turn to the site to regularly get news there. And a quarter of U.S. adults regularly get news from YouTube, while smaller shares get news from Instagram (13%), TikTok (10%) or Reddit (8%).

- Pew Research Center found in surveys of U.S. adults that a majority distrust social media sites as sources of political and election news, believe social media has a negative impact on the “way things are going” in the country and believe the firms running the platforms censor political viewpoints.

In the United States, Pew surveyed 3,581 U.S. adults from March 21 to 27, 2022. Participants are in Pew Center’s American Trends Panel (ATP), an online survey panel recruited through a national random sampling. The survey is weighted to represent the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories.

With distrust of social media so widespread, what is the best way to educate, inform and engage you about managing money wisely? Please use our website contact page or call our office to let us know.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for NFI, LLC. and is not intended as legal or investment advice.

©2023 Advisor Products Inc. All Rights Reserved.

More articles

- At A Unique Moment In Financial History, Five Takeaways From Fed Chair's Press Conference

- Developing Portfolio Return Expectations

- Why Investors Like Our Financial Commentary

- What To Do Now To Build Wealth

- The New Rules On Retirement Affect Americans Of Any Age And Income

- Sweeping New Law Changes Retirement Planning In 2023

- You Can’t Trust The Phone Number On The Back Of Your Credit Card Anymore

- American Exceptionalism Is A Legitimate Financial Philosophy

- Investor Note: Post Pandemic Inflation Crisis Highlights U.S. Exceptionalism

- Federal Reserve Likely To Dial Back Rate Hikes But They’re Far From Over

- Test Your Personal Financial Knowledge In 30 Seconds

- The Inspirational Story Of Hetty Green, The Warren Buffett Of The Early 1900s

- Keep Your Eyes On The Bad Economic News

- Let’s Talk About Stock Market Volatility

- Bracing For Recession Amid A Bear Market

More

-

With Stocks Breaking Records And Crises Unfolding, What’s An Investor To Think